The importance of timesheets in supporting R&D claims

Research and development (R&D) is crucial for innovation. It drives the discovery of new ideas, advancements, and solutions–helping businesses stay competitive.

Yet, lots of businesses, especially smaller ones, struggle with gathering the necessary documents and evidence for a successful R&D claim. Meeting specific criteria set by regulatory authorities, keeping accurate records, and efficiently allocating project resources are challenges to overcome.

Reduce the risk of challenges from authorities when claiming tax relief. This article highlights the crucial role timesheets play in making R&D claims, outlines the challenges, and offers best practice tips.

We’ll cover:

- What is R&D?

- The challenges for making R&D claims

- The crucial role of timesheets

- R&D timesheets: 5 best practices

- Streamline your R&D processes with Appogee Time Tracker

What is R&D?

R&D is a flexible and diverse process that helps companies adjust, develop new ideas, and stay competitive. It involves staying open to learning, trying out new things, and being ready to invest resources to improve products or processes.

Businesses that invest in R&D activities can claim R&D tax credits from HMRC. These credits allow companies to get a portion of their R&D expenses back as a tax benefit. So, if a company spends money on qualifying R&D efforts, the government may offer tax credits, which can reduce the company's overall tax liability.

Usually, R&D activities are linked to science and technology progress. However, they can also involve improvements in a business's operations and structure. For example, improving healthcare processes, such as patient care pathways. This can include identifying areas for improvement and introducing innovative solutions to improve healthcare accessibility.

Here are some of the core features of R&D:

- Long-term planning. R&D is often part of a company's long-term strategic plan. The benefits of R&D investments may not be immediately apparent but can be crucial for future success.

- Problem solving. R&D involves dealing with challenges and solving problems. This might include solving technical issues or overcoming obstacles to reach a particular goal.

- Innovation. Companies investing in R&D meet the changing needs of customers by driving the creation of new products, services, or solutions. For example, the energy sector invests in alternative technologies, such as wind and solar power, to develop high-efficiency solar panels or wind turbines.

- Regulatory compliance. In some industries, R&D is necessary to comply with evolving regulations and standards. This is particularly true in sectors where safety, environmental impact, or other regulatory concerns are essential, such as pharmaceutical, chemical, and aerospace industries.

- Market competitiveness. Businesses that invest in R&D gain a competitive edge. Innovations from R&D efforts can lead to unique selling points–helping them differentiate themselves in the market. For example, a tech company investing in cutting-edge software features.

- Working in partnership. R&D activities can involve collaboration with external partners, such as research institutions, universities, or medical and health sectors. Collaborative efforts can combine diverse expertise to develop new medical devices and technologies, such as advanced imaging equipment.

Companies can enhance their profits by grasping customer needs and introducing fresh technologies–vital for long-term growth.

Nonetheless, engaging in R&D involves uncertainty and risk. Some projects may not succeed, and rewards might not come quickly. Yet, successful R&D can lead to important discoveries that boost a company's profits.

The challenges for making R&D claims

Businesses often encounter several difficulties when it comes to R&D claims.

Firstly, working out whether a project qualifies for R&D tax credits can be complex. The eligibility criteria and timescales may be difficult to understand and subject to interpretation, making it challenging for businesses to navigate. Claims often have strict deadlines, and companies may face difficulty submitting their claims on time. Delays can lead to potential penalties and missed opportunities for claiming credits.

As rules for R&D tax credits change over time, it can be challenging for businesses to keep track. Not staying updated may affect their ability to get the most out of available incentives.

Secondly, according to HMRC, all R&D claims must be supported by relevant records. Failure to document qualifying activities and expenses means companies may not fully take advantage of available tax credits, grants, or other incentives. HMRC may scrutinise R&D claims, and businesses face the risk of audits to verify the validity of their claims. And insufficient documentation or inaccuracies add more administrative work.

Thirdly, R&D can be expensive, especially for small businesses. They may find it hard to set aside enough money for R&D projects, making it challenging to stay innovative. Time-tracking software, like Appogee Time Tracker, can help by accurately recording R&D tasks and costs, making it easier for small businesses to manage their resources efficiently and claim the benefits they deserve.

Thirdly, since timesheets and payroll data should be retained for at least six years after the claim period, Appogee Time Tracker seamlessly integrates with Xero. You can effortlessly synchronise data and simplify payroll processes, ensuring access to essential documentation for potential future inquiries.

Finally, R&D claims depend on the country they're in. Companies in different places might struggle to align their R&D claims with various tax rules, making it tricky to maximise benefits globally.

Automated reporting, for example, can generate standardised reports, making it simpler to compile and present necessary information for R&D claims, ensuring compliance with local tax rules.

The crucial role of timesheets

To be eligible to claim R&D tax credits, a business has to demonstrate that they've spent money or resources on R&D projects.

And that’s precisely where time-tracking software is invaluable.

This technology offers a comprehensive tool for tracking and managing employee time, generating accurate timesheets to serve as evidence for qualifying R&D work and enhancing the credibility of a claim.

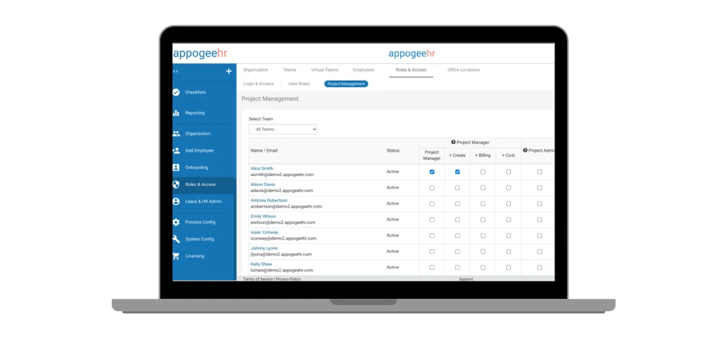

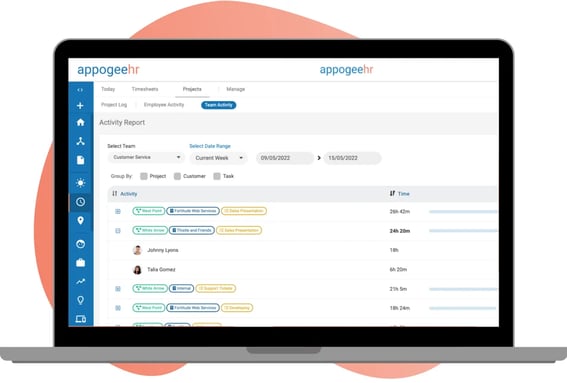

By tracking tasks against customers, projects, and teams, businesses get a detailed record of employees' time on specific R&D projects. This accuracy is crucial when calculating the proportion of their working hours dedicated to eligible R&D activities.

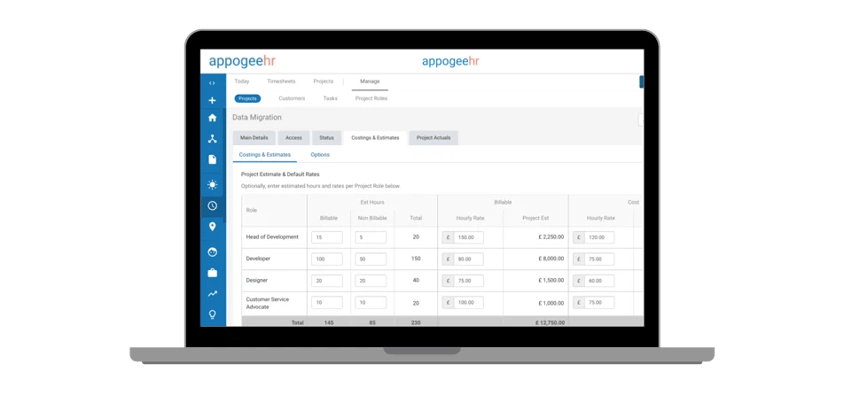

Since each staff member plays an important part in an R&D project, they may have different salary rates. Electronic timesheets give companies a clear picture of actual project costs by considering different pay scales and determining how much employees are billed for each R&D activity.

As well as tracking costs, properly maintained timesheets help demonstrate compliance with regulations, reducing the risk of challenges or audits by tax authorities.

Let's put that into perspective and say a manufacturing plant produces chemical products and is subject to stringent safety regulations. The health and safety team develops and optimises production processes to comply with environmental and safety standards.

As the team maintains timesheets that track the time spent on various R&D activities, such as safety assessments and developing new procedures, the manufacturing business can use these timesheets to evidence its commitment to compliance, minimising the risk of challenges or audits related to safety regulations.

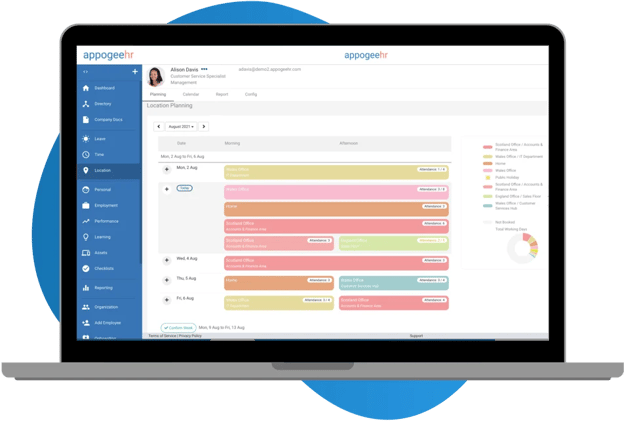

In addition, timesheets can improve communication among team members by providing insight into each individual's availability for R&D tasks. Staff location recording software, for example, lets you plan R&D activities with team members regardless of work location.

By creating bookable office areas and zones and tracking which days staff work at home or in the office, businesses ensure employees working directly on R&D projects are available for meetings while evidencing the time spent. This information enhances communication and ensures that team members are aligned in their efforts.

Plus, access to detailed timesheet data helps improve decisions about R&D priorities, resource allocation, and strategic planning. For instance, by leveraging timesheets to understand time spent on tasks, businesses can ensure teams allocate dedicated time for learning and development or performance management reviews that support R&D projects.

Finally, timesheets serve as a tool to check how well R&D processes are working and how efficient they are. This internal review can help identify areas for improvement and streamline future projects. Find out whether there are any bottlenecks in testing or evaluate the efficiency of new features.

As you can see, having accurate timesheet data is not a nice to have but a must-have for claiming R&D tax credits. They simplify gathering information necessary for tax credit applications, providing companies with readily accessible details and minimising the risk of regulatory challenges or audits.

R&D timesheets: 5 best practices

Adopting the five best practices below can enhance the credibility of claims and increase the likelihood of securing financial benefits for R&D efforts.

1. Develop a robust system for R&D projects

Accuracy leads to successful claims. Establish a robust system to track and assign employee time for R&D work and keep up-to-date timesheets showing the hours spent on eligible projects. This helps make your R&D claims more credible and helps manage resources and plan projects effectively.

2. Keep meticulous records of all expenses related to R&D projects

Categorise expenses appropriately, distinguishing between qualifying and non-qualifying costs. This level of detail is essential for demonstrating the legitimacy of claimed expenses during the R&D tax credit application process.

3. Make sure your records are accessible and secure

This will be important during the claim preparation and afterward, if HMRC wants to audit any information. If needed, train relevant personnel on the importance of accurate record-keeping for R&D claims and provide guidance on proper documentation practices.

4. Set up periodic reviews

Review and update record-keeping procedures to align with current R&D tax credit regulations and guidelines. Collaborate with tax professionals or experts familiar with R&D tax credit requirements to stay informed about evolving rules and optimise your record-keeping practices accordingly.

5. Maintain data security

Maintain data security for employee timesheets by implementing secure access controls, encryption, and regular monitoring to safeguard sensitive information.

Timesheet software, like Appogee Time Tracker, has robust security features to protect sensitive information. Regular backups can be automated, reducing the risk of data loss and ensuring the integrity of R&D records.

Streamline your R&D processes with Appogee Time Tracker

Secure tax relief for your R&D projects and maintain innovation. Get the financial benefits you deserve by acknowledging the importance of timesheets in documenting R&D efforts.

Our advanced timesheet system allows you to accurately record and analyse the time spent on various R&D activities, helping you identify improvement areas and make better decisions.

However, we’re not experts in this field, so we suggest you speak with a professional tax advisor for personalised advice.

R&D claims FAQs

How long does it take for HMRC to process R&D claims?

HMRC aims to process most R&D tax credit claims within 28 days. However, this depends on how complex your business is, the type of claim, and when you submit it during the year.

What are R&D supporting activities?

Examples include (but are not limited to):

- Design adaption and optimisation

- Quality assurance and testing

- R&D project planning

- Training required to directly support an R&D project

- Prototyping

- Production trials

How do I make my R&D claim successful?

Explain the scientific or technological uncertainties you faced during the project and how you overcame them.

Keep accurate records of R&D activities, including the time and resources spent on the project. This will help you to demonstrate the nature and extent of your R&D activities to HMRC.

Seek professional advice from a tax specialist or R&D expert to ensure your claim is accurate and complete.

Ready to scrap complex timesheets? Learn how Appogee Time Tracker can transform your R&D claim process and book a demo with our HR Transformation Team. Alternatively, start your free 14-day trial with us today.

.webp?height=168&name=appogeehr%20(1).webp)

.png?width=620&height=372&name=LinkedIN%20social%20templates%20(8).png)